Unlocking Market Secrets: The Power of the Wyckoff Zone

Those who understand the game of the market play ahead of the crowd. The rest just chase the tape.-

When it comes to understanding price movements, many traders chase after the latest indicators or market hacks. But sometimes, the most powerful strategies come from the foundations of technical analysis—refined over decades and still relevant today. One such gem? The Wyckoff zone.

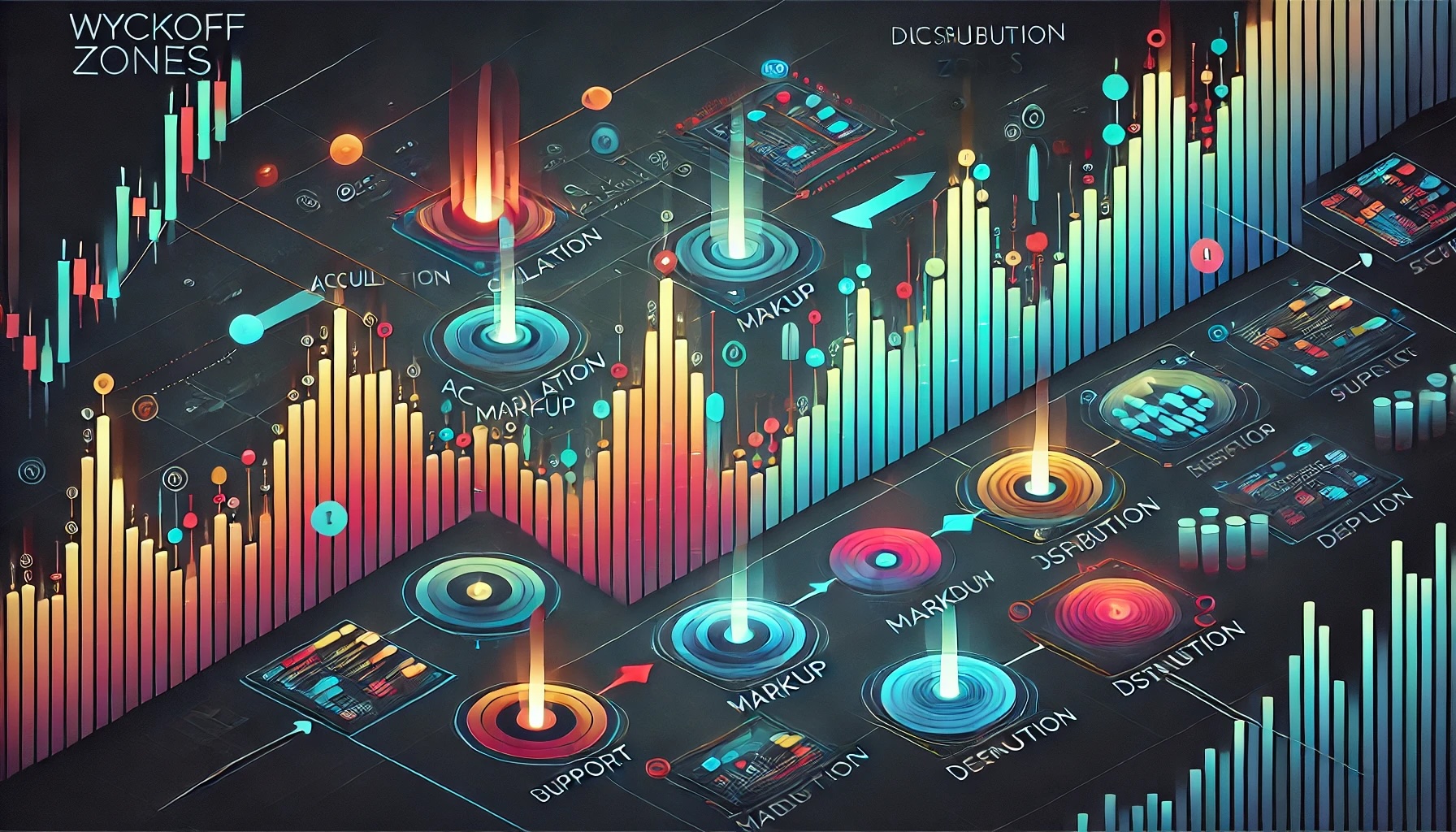

What Is the Wyckoff Zone?

The Wyckoff zone is not a single point or level—it’s a conceptual range that highlights areas of institutional activity. Based on Richard D. Wyckoff’s century-old methodology, it represents the accumulation and distribution zones where smart money is quietly building or offloading positions before major price moves occur.

A Brief History

Richard D. Wyckoff, a Wall Street pioneer in the early 1900s, developed a systematic approach to reading the market based on volume and price action. His methods were designed to follow the footprints of large operators—those capable of moving markets. Over time, his principles were adapted into what we now call the Wyckoff Method, a framework that still influences professional traders, hedge funds, and sophisticated algorithms.

Strategy & Structure

The Wyckoff Method breaks down market cycles into four key phases: accumulation, markup, distribution, and markdown. Within these phases, the Wyckoff zone refers to specific areas—often horizontal zones on the chart—where price consolidates as institutions prepare for the next move.

In these zones, you’ll often see:

Decreasing volatility and volume absorption

False breakouts that trap retail traders

Support and resistance flips disguised as noise

Spring patterns, tests, and signs of strength

The strategy is simple in theory: identify the zone, wait for confirmation, and ride the wave triggered by institutional activity.

Why It Works

The power of the Wyckoff zone lies in its alignment with how the market actually works. It doesn’t rely on lagging indicators or retail noise—it focuses on the behaviour of the market’s real movers. It allows traders to:

Enter early before the crowd

Avoid fakeouts and whipsaws

Ride the trend from its inception

Use tighter stop losses with higher reward-to-risk setups

Wyckoff + Smart Automation = A Deadly Combo

Now, imagine if you could automate this edge.

Scalper Hunter Pro (SCP) does just that. By integrating the Wyckoff zone logic into a robust trading engine, SCP identifies high-probability entries where smart money is active—and acts on them faster than human reflexes allow.

Whether you’re a seasoned trader or just starting out, SCP gives you the power to:

Catch breakouts before they run

Avoid chop and noise

Trade with institutional logic on your side

👉 Explore SCP now and see how it can change the way you trade.

Conclusion

The Wyckoff zone isn’t just theory—it’s a time-tested concept rooted in how markets really work. It has guided generations of successful traders, and now, it’s powering the next generation of smart trading algorithms. With tools like SCP, you don’t just follow the market—you anticipate it.